.png)

The TD Q Advantage

TD Q Canadian Dividend ETF (TQCD) | TD Q Global Dividend ETF (TQGD)

TD Q ETF Solutions

The TD Quantitative (TD Q) Dividend Exchange-Traded Funds (ETFs) aim to provide broad exposure to high-quality dividend-paying stocks in their respective markets. At TD Asset Management Inc. (TDAM), we believe high interest rates will cause economies to slow, and we see the potential for shallow recessions in major economies in 2024. In such an environment, quality companies with a track record of profitability, cash flow generation, and dividend increases should outperform the broad market.

TD Q Canadian

Dividend ETF

0.35% Management Fee

Uses a quantitative approach that screens for equity securities of Canadian issuers that provide strong current dividend income, and the potential for dividend growth.

TD Q Global

Dividend ETF

0.40% Management Fee

Uses a quantitative approach that screens

for equity securities of global issuers

that provide strong current dividend

income, and the potential for dividend growth.

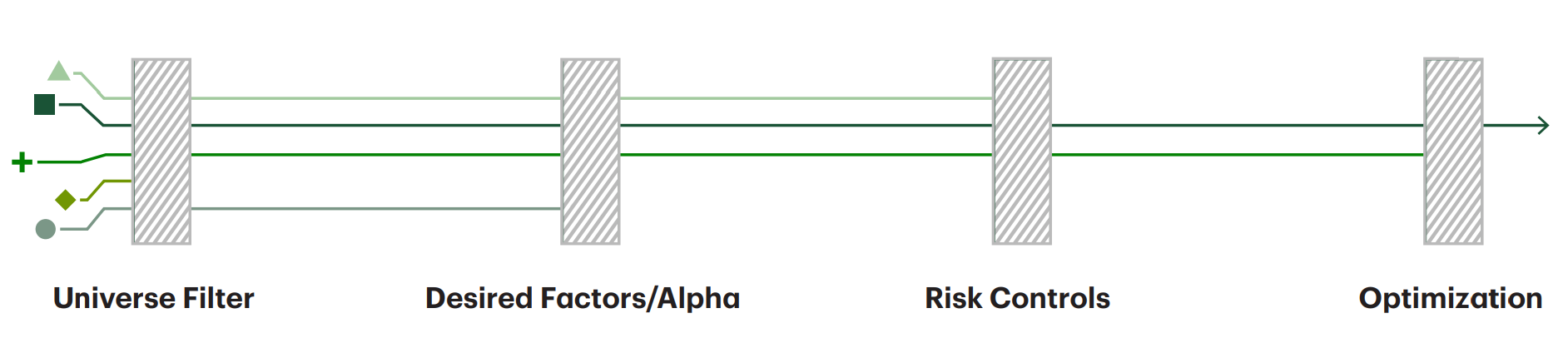

TD Q ETF strategies follow an investment process that screens the investment universe, gaining exposure to the appropriate factors or alpha while seeking to minimize risk using proprietary models and optimization.

TDAM leverages the expertise of its TD Q Team with TD Q ETFs.

The TD Q Team at TDAM actively manages the TD Q ETFs by combining the science of quantitative investing with the deep expertise of a broad portfolio management team.

Experience

Over 25 years of managing

quantitative strategies.

Value

Offering low-cost quantitative

solutions for any investor.

Scale

One of the largest managers of

quantitative equity strategies in Canada.1

Deep Technical Skills

A diverse and experienced team

with a broad range of skills.

Quantitative investing is a sophisticated approach to investment management and security

selection. It often uses a combination of computer models, data analytics and professional

judgement in the pursuit of excess returns (alpha) above a market benchmark (like the S&P 500

Index) while seeking to create an optimal portfolio that balances risk and return.