NASDAQ: INM

Redefining the Future of Alzheimer’s & Neurodegenerative Treatment

Investment Highlights

InMed is a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates targeting the CB1/CB2 receptors

• Multi-program pipeline targeting high unmet-need indications — Alzheimer’s, Dry AMD (ocular), and Dermatology

• Lead candidate INM-901: Oral small molecule for Alzheimer’s that crosses the blood-brain barrier, reduces neuroinflammation, and shows cognitive improvements in preclinical studies

• Undervalued opportunity: ~$9M market cap sitting below current cash position, offering full pharma pipeline + revenue stream at virtually no enterprise value

• Strong management team with deep experience in biotech drug development, commercialization, and capital markets

• Cash runway into late 2026 limiting near-term dilution risk

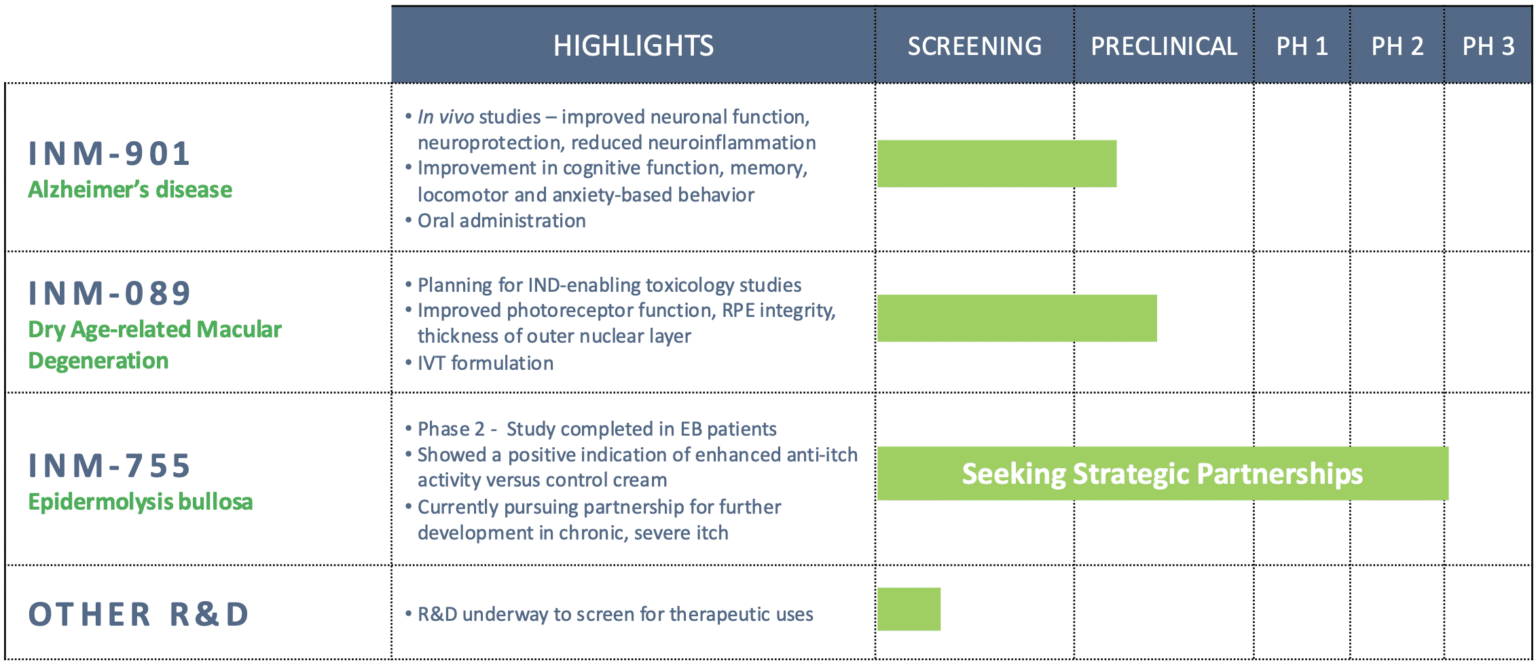

Pipeline Overview

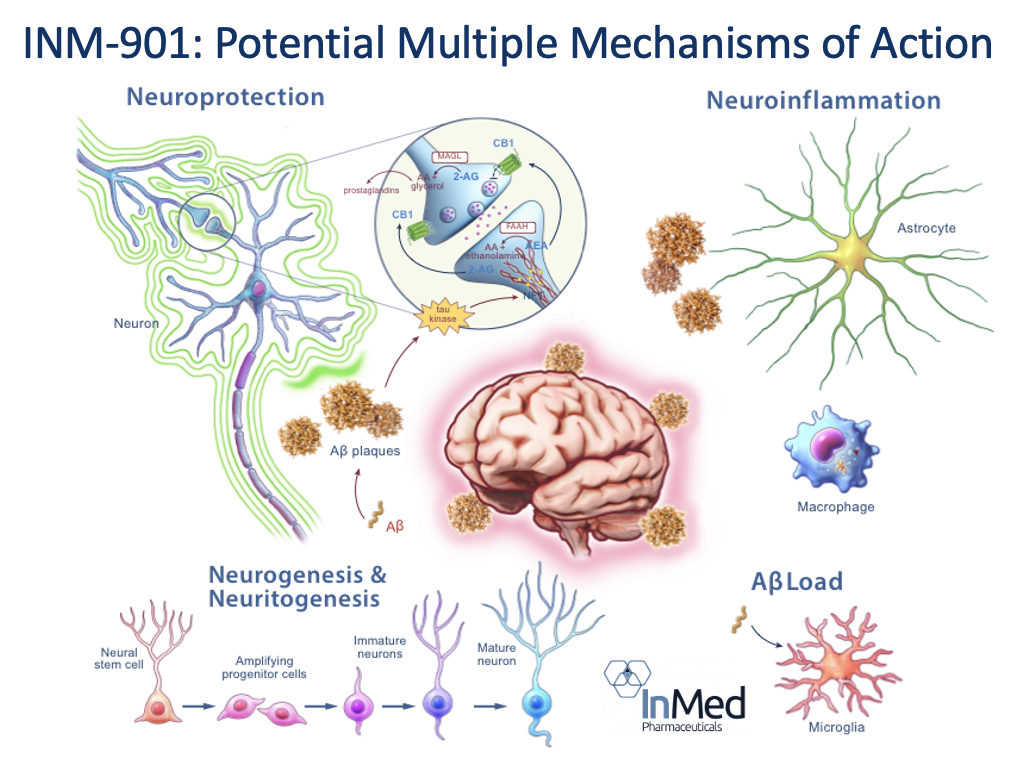

INM-901 — Alzheimer’s Disease

• Oral small molecule that crosses the blood-brain barrier

• Reduces neuroinflammation, promotes neurite outgrowth, enhances neuronal function

• Demonstrated positive trends in cognition, memory, locomotor and anxiety-based behavior

• Aligned on current “beyond amyloid” trend (multi-pathway)

• Targeting a $13B+ and rapidly growing Alzheimer’s market

• Demonstrated statistically significant reduction in several key pro-inflammatory markers

INM-089 — Dry Age-related Macular Degeneration (AMD)

• Proprietary small molecule cannabinoid analog

• Preserves photoreceptor structure and retinal function in preclinical models

• Addresses a leading cause of blindness affecting 150M+ people globally

• No FDA-approved treatments currently exist

INM-755 — Dermatology

• Cannabinol (CBN) cream completed Phase 2 in EB

• Demonstrated clinically meaningful anti-itch activity and safety

• Seeking strategic partners for advancement