TSXV: HI | OTCQB: HDSRF

The Time is Right:

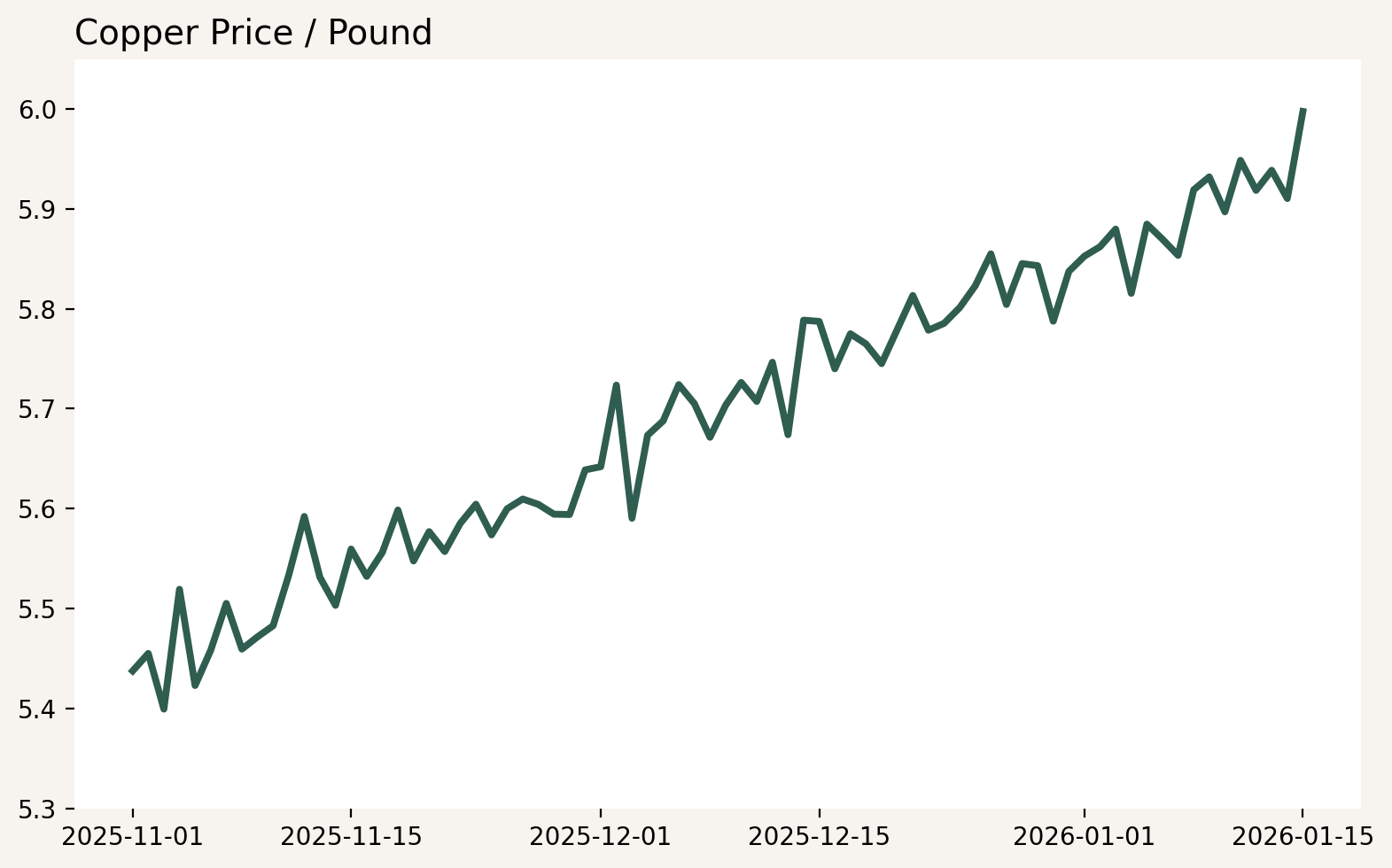

Capitalize on the US Copper Surge

Why Copper?

Copper is essential to modern life and the backbone of electrification. With supply tightening and demand soaring, copper is positioned for a sustained bull market. Now is the time to secure your stake in the copper boom.

Why Highland Copper?

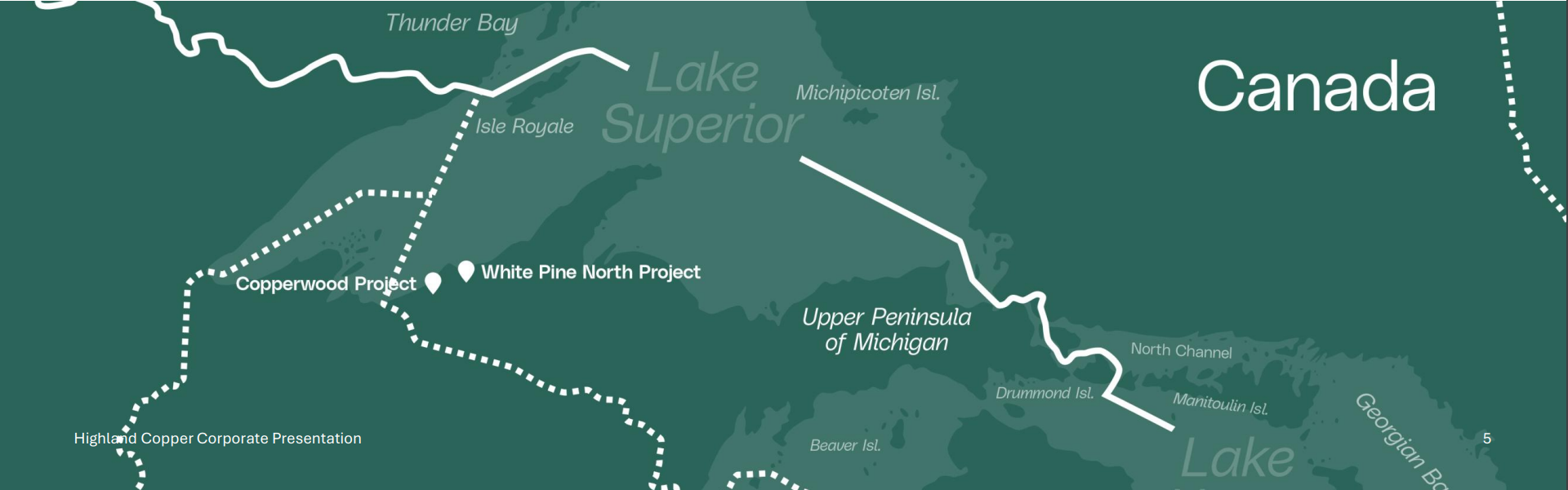

Highland Copper is the premier choice for investors seeking immediate leverage to the copper surge. Its flagship Copperwood Project is a rare, fully permitted U.S. copper project, backed by a completed feasibility study and ready for near-term construction. With strong federal support for domestic copper supply, Highland is moving aggressively toward a 2026 construction decision and potential production by 2029 - making it the right asset, in the right place, at the right time.

Highland Copper Offers High Leverage to Copper in Michigan, with Strong Federal Support and Upside from a Near-Term FID Re-Rating

Fully Permitted

Copperwood is one of few fully-permitted US copper projects. Feasibility Study completed in 2023 by G Mining

Peer-Leading Leverage to Copper Price

25% increase in copper price increases Copperwood NAV by 300%

Higher Price/NAV multiple transitioning to production

Top-Tier Jurisdiction

Copper designated as Critical Mineral by USGS. Strong federal and state funding support and strong local backing for development

Near-Term Production

Substantially de-risked, early site work and concurrent reclamation complete, detailed engineering underway, targeting a 2026 construction decision and 2029 production.

Advancing Federal Funding

Received LOI from U.S. EXIM for $250 million project financing. In active discussion with DOE and DOD.

Highland Copper Signed Definitive Agreement to Sell 34% Interest in White Pine for US$30M - Transaction Eliminates Debt and Fully Funds Copperwood to Final Investment Decision

January 2026

Execution in 2025 has advanced Highland across all key areas of project development, financing, and corporate development. Following the White Pine transaction, Highland is debt-free, funded through a construction decision at Copperwood, and firmly focused on near-term production.

2025 Execution Highlights

• 1.7% increase in copper recovery - improving economics versus the feasibility study

• $250M EXIM letter of interest received - advancing project financing and representing ~60% of the ~$400M initial capital required to build and commission the mine

• Phase 1 detailed engineering completed - advancing construction readiness

• Greenstone block sold to institutions - trading overhang eliminated

• Early site work and concurrent reclamation completed - demonstrating site readiness and commitment to responsible development

Given its modest share price performance in 2025 relative to peers, Highland is well positioned as a strong value opportunity for 2026. With key upcoming catalysts, the trading overhang removed, and significant leverage to rising copper prices, the investment thesis is compelling. Notably, a 50% increase in the copper price (from $4.00 to $6.00 per pound) drives a fivefold increase in NPV - from $168M to $855M - based on Feasibility Study assumptions.